The Volatile World of Commodity Prices: Understanding Trends and Influences

lightgrey-peafowl-578620.hostingersite.com is dedicated to providing in-depth analysis of global financial markets, and one of the most dynamic and impactful areas is the commodities market. Commodity prices, the raw materials that underpin the global economy, are constantly fluctuating, driven by a complex interplay of supply, demand, geopolitical events, and macroeconomic factors. Understanding these price movements is crucial for businesses, investors, and policymakers alike. This article delves into the world of commodity prices, examining the key drivers, historical trends, and the potential implications for the global economy.

What are Commodities?

Commodities are basic goods used in commerce that are interchangeable with other goods of the same type. They are often categorized into four main groups:

- Energy: This includes crude oil, natural gas, coal, and refined products like gasoline and heating oil. Energy commodities are essential for transportation, electricity generation, and industrial processes.

- Metals: This category comprises both precious metals (gold, silver, platinum, palladium) and industrial metals (copper, aluminum, iron ore, nickel). Metals are used extensively in manufacturing, construction, and technology.

- Agriculture: This includes crops like corn, wheat, soybeans, rice, coffee, sugar, and livestock like cattle and hogs. Agricultural commodities are the foundation of the global food supply.

- Livestock: This includes livestock products such as meat and dairy.

Key Drivers of Commodity Prices

Several factors exert significant influence on commodity prices:

-

Supply and Demand: This is the fundamental principle governing price determination. When demand exceeds supply, prices tend to rise, and vice versa. Supply can be affected by factors such as weather conditions (for agricultural commodities), geopolitical instability (for energy commodities), and technological advancements (for metals). Demand is influenced by economic growth, population growth, and changing consumer preferences.

- Supply-Side Shocks: Unexpected events that disrupt supply can lead to sharp price increases. Examples include droughts affecting crop yields, strikes at mines, or political instability in oil-producing regions.

- Demand-Side Shocks: Sudden increases in demand can also push prices higher. This can be driven by rapid economic growth in emerging markets, new technological innovations that require specific commodities, or changes in government policies.

-

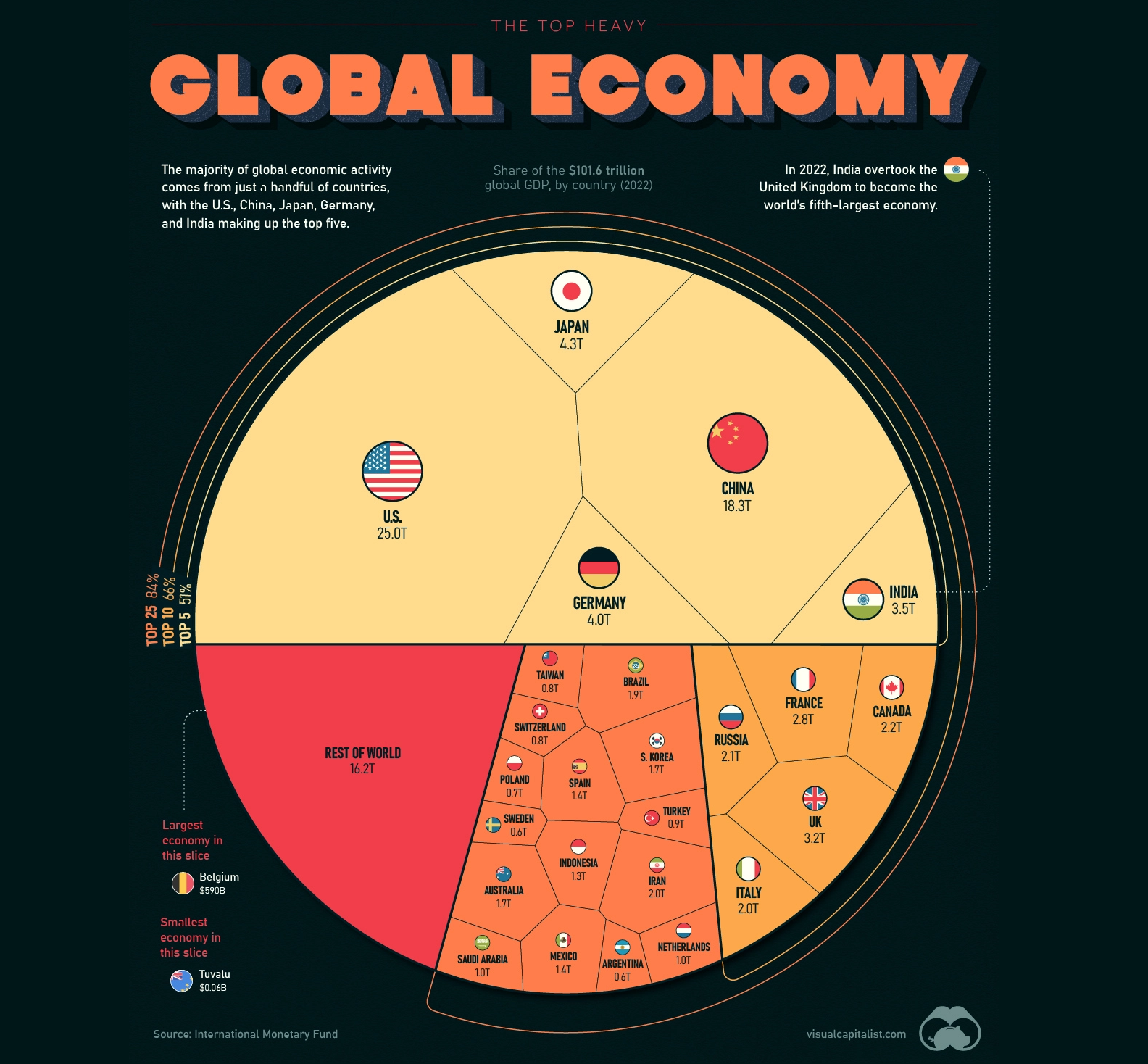

Economic Growth: Strong economic growth typically leads to increased demand for commodities, as businesses ramp up production and consumers increase spending. Conversely, economic recessions tend to dampen demand and put downward pressure on prices.

- Global Economic Indicators: Key indicators like GDP growth, manufacturing indices, and unemployment rates can provide insights into the overall health of the global economy and its impact on commodity demand.

-

Geopolitical Events: Political instability, conflicts, and trade disputes can disrupt supply chains and create uncertainty in the markets, leading to price volatility. Sanctions imposed on commodity-producing countries can also have a significant impact on prices.

- Geopolitical Risk Premium: In times of heightened geopolitical tension, a "risk premium" may be added to commodity prices to reflect the potential for supply disruptions.

-

Currency Fluctuations: Commodity prices are often denominated in US dollars, so changes in the value of the dollar can affect prices. A weaker dollar tends to make commodities more attractive to buyers using other currencies, leading to increased demand and higher prices.

- Dollar Index (DXY): The DXY measures the value of the US dollar against a basket of major currencies. Monitoring the DXY can provide insights into the potential impact of currency fluctuations on commodity prices.

- Inflation: Commodities are often seen as a hedge against inflation, as their prices tend to rise along with the general price level. During periods of high inflation, investors may flock to commodities as a store of value, further driving up prices.

-

Interest Rates: Higher interest rates can increase the cost of holding commodities, as it becomes more expensive to finance inventories. This can lead to reduced demand and lower prices.

- Federal Reserve Policy: The US Federal Reserve’s monetary policy decisions, particularly regarding interest rates, can have a significant impact on commodity prices.

- Technological Advancements: New technologies can impact both the supply and demand for commodities. For example, the development of fracking technology has significantly increased the supply of natural gas, while the rise of electric vehicles is reducing demand for gasoline.

-

Speculation: Speculative trading in commodity futures markets can amplify price movements. Large institutional investors, hedge funds, and individual traders can all contribute to price volatility.

- Managed Money Positions: Tracking the positions of managed money in commodity futures markets can provide insights into the level of speculative activity.

- Weather Patterns: Weather patterns, especially for agricultural commodities, can significantly influence production and therefore price.

Historical Trends in Commodity Prices

Commodity prices have historically exhibited cyclical patterns, with periods of boom and bust. These cycles are often driven by fluctuations in global economic growth and investment.

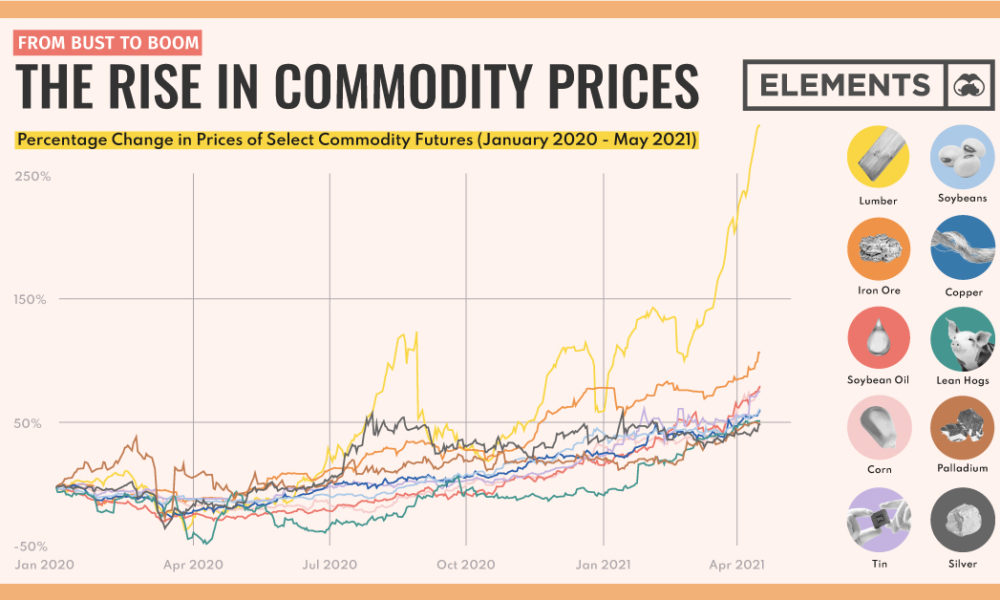

- The Commodity Supercycle: A "supercycle" is a prolonged period of rising commodity prices, driven by sustained growth in demand, often from emerging markets. The early 2000s saw a commodity supercycle fueled by rapid industrialization in China.

- Price Volatility: Commodity prices can be highly volatile, particularly in the short term. This volatility can create both opportunities and risks for investors and businesses.

- Long-Term Trends: In the long term, commodity prices are influenced by factors such as technological innovation, resource depletion, and changing consumption patterns.

Implications for the Global Economy

Commodity prices have far-reaching implications for the global economy:

- Inflation: Rising commodity prices can contribute to inflation, as businesses pass on higher input costs to consumers.

- Economic Growth: High commodity prices can dampen economic growth, as they increase the cost of production and reduce consumer spending.

- Trade Balances: Countries that are net exporters of commodities tend to benefit from rising prices, while countries that are net importers may suffer.

- Emerging Markets: Many emerging markets are heavily reliant on commodity exports, so changes in commodity prices can have a significant impact on their economies.

- Investment Decisions: Commodity prices play a crucial role in investment decisions across various sectors, including energy, mining, agriculture, and manufacturing.

- Consumer Prices: The prices consumers pay for many goods and services are directly affected by the price of raw materials.

Strategies for Navigating Commodity Price Volatility

Businesses and investors can employ various strategies to manage the risks associated with commodity price volatility:

- Hedging: Using futures contracts or other financial instruments to lock in prices and reduce exposure to price fluctuations.

- Diversification: Spreading investments across different asset classes, including commodities, to reduce overall portfolio risk.

- Supply Chain Management: Optimizing supply chains to reduce costs and improve efficiency.

- Strategic Sourcing: Developing relationships with multiple suppliers to ensure a reliable supply of commodities.

- Fundamental Analysis: Conducting thorough research on the supply and demand dynamics of specific commodities.

- Technical Analysis: Using charts and other technical indicators to identify potential price trends.

Conclusion

Commodity prices are a vital barometer of the global economy, reflecting the interplay of supply, demand, and a multitude of other factors. Understanding the drivers of commodity price movements is essential for businesses, investors, and policymakers seeking to navigate the complex and often volatile world of raw materials. By carefully analyzing market trends and employing appropriate risk management strategies, stakeholders can mitigate the challenges and capitalize on the opportunities presented by commodity price fluctuations. The information presented here is intended for informational purposes only, and is not financial advice. It is vital to consult with a financial professional before making any investment decisions.